How Property Taxes & Assessments Impact Your Home Value in Rutherford County (And How to Appeal)

2026 Guide for Homeowners in Murfreesboro, TN

Property taxes are a fact of life for homeowners in Rutherford County, but many people don’t realize how deeply they impact their perceived home value, potential sale price, and even their ability to refinance. In this guide, we’ll break down how the property tax system works in Murfreesboro and greater Rutherford County, how assessments influence your home's market value, and what you can do if you think your property is over-assessed.

🏡 Understanding Property Taxes in Rutherford County

Your property tax bill is based on two primary things:

- Assessed Value — This is the value the county assigns to your home for tax purposes.

- Tax Rate — Set annually by your local government.

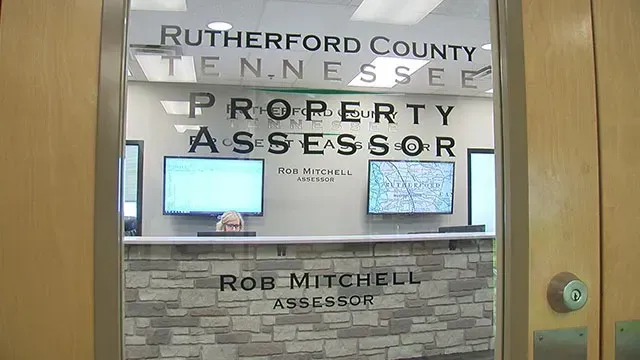

In Rutherford County, the assessed value is a percentage of your home's appraised value as determined by the County Assessor of Property. For residential properties in Tennessee, the assessment ratio is 25% of the appraised market value.

So, if the county says your home is worth $400,000, your assessed value would be $100,000, and your property tax is calculated from that figure.

📊 How Do Assessments Impact Perceived Home Value?

While your official property tax assessment isn’t necessarily the same as your market value, it can still influence how buyers, lenders, and even agents perceive your home.

- High assessments can lead to higher tax bills, which might deter some buyers.

- Low assessments could be a red flag that your home is undervalued or lacking recent updates.

Assessments are often based on mass appraisal systems that don’t reflect recent renovations, unique features, or upgrades, and they can lag behind true market conditions by months or even years.

🚫 What If Your Property Is Over-Assessed?

It’s more common than you think. If your assessed value seems too high, you could be paying more than your fair share in property taxes. Fortunately, Rutherford County allows homeowners to appeal their property assessment through a formal process.

🔧 How to Appeal a Property Tax Assessment in Rutherford County

Here’s a step-by-step guide to the appeal process:

- Review Your Assessment

Look at the notice mailed by the Rutherford County Assessor’s Office. Check the appraised value, assessed value, and property description. - Gather Evidence

You’ll need data to support your appeal. This can include:

- A recent professional appraisal (this is where H&H Appraisal can help)

- Recent sales of similar properties (comps)

- Documentation of inaccuracies in the county's property description

- File a Formal Appeal

Contact the Rutherford County Board of Equalization to request a hearing. Appeals are usually accepted for a limited time following the annual assessment notice (typically in May or June). - Attend Your Hearing

Present your evidence calmly and clearly. A strong, independent appraisal report can be the most persuasive piece of documentation. - Await the Decision

If successful, your assessed value will be reduced, which lowers your future property tax bills.

❓ Why Hire an Independent Appraiser for Your Tax Appeal?

The county uses mass appraisal techniques based on averages, not the specific features and condition of your home. A licensed appraiser can provide a much more accurate and defendable value.

At H&H Appraisal, we specialize in:

- Tax appeal appraisals in Rutherford County

- Reports tailored for submission to the Board of Equalization

- Defensible valuations backed by recent comps, detailed inspection, and local market expertise

💼 Final Thoughts: Protect Your Equity

If your property is over-assessed, you’re not just overpaying in taxes — you might be impacting your home’s financial appeal to future buyers and lenders. Filing a tax appeal is your right as a homeowner, and a strong appraisal is often the key to success.

Whether you're in Murfreesboro, Smyrna, La Vergne, or elsewhere in Rutherford County, we're here to help you fight back with data, not guesswork.

Want to see if your home is over-assessed? Reach out today for a consultation and get the facts about your property value.

Understanding Home Appraisals in Middle Tennessee

Homeowners, potential buyers, and real estate professionals across Middle Tennessee often face the challenging task of understanding home appraisals. The process can be intimidating with fears of undervaluation or unexpected hurdles affecting property decisions. But fear not, because H&H Appraisal offers professional, accurate, and timely appraisal services to make these decisions with confidence. Here's what you need to know.

Why Home Appraisals Matter

Whether you're buying, selling, or refinancing, the value determined by a home appraisal can significantly impact financial outcomes. A low appraisal might derail a sale or refinance, while an accurate appraisal can ensure you’re making informed decisions. In an area bustling with diverse property types and booming real estate markets like Nashville and Franklin, understanding appraisals is crucial.

Key Challenges in Appraisal Processes

The appraisal process can often be nuanced, especially in Middle Tennessee where market dynamics vary greatly between locales like Smyrna and Hendersonville. Common challenges include:

- Varying property conditions affecting value.

- Market volatility causing appraisal discrepancies.

- Unique characteristics of homes that aren't adequately accounted for.

However, these challenges can be navigated with expert guidance from a certified residential appraiser in TN, such as those at H&H Appraisal.

The Appraisal Process: What to Expect

The home appraisal process typically involves a thorough inspection of the property, assessment of key factors such as location and condition, and a comparison with similar properties recently sold. Here's a step-by-step guide:

Preparing for the Appraisal

- Gather and present relevant documents including recent renovations and tax information.

- Ensure your property is clean and accessible on the appointment day.

- Address minor repairs that could negatively impact the appraisal judgment.

While this might seem daunting, H&H Appraisal helps you prepare effectively, ensuring nothing crucial is overlooked.

Factors Impacting Home Appraisal Values

The nuances of Tennessee real estate mean that several factors will impact the final appraisal value:

- Location within Middle Tennessee, with cities like Mt. Juliet typically attracting different values compared to Shelbyville.

- Condition and age of the property.

- Recent sales data of comparable homes in the area.

Understanding these factors can demystify the appraisal value, allowing homeowners to manage expectations and strategic decisions effectively.

Solutions for Common Appraisal Issues

If you're confronting a low appraisal, don't panic. There's often room for negotiation or appeal, especially if discrepancies are identified. Corrective measures can be taken, from providing additional documentation to challenging inaccuracies. H&H Appraisal can guide you through these solutions, ensuring your interests are well-represented.

Conclusion: Leveraging Expertise with H&H Appraisal

Let's face it: the home appraisal landscape is intricate and can be overwhelming. By leveraging the expertise of H&H Appraisal, you're not just getting an appraisal; you're gaining insights and clarity necessary for making informed real estate decisions. Connect with us today to ensure your property’s true value is realized.